Travel Smart: Managing Your Money Across Multiple Currencies

For anyone who’s ever set foot in a foreign country, you know that managing money in multiple currencies can be one of the biggest challenges of travel. Even if you’re only traveling to one other country, understanding exchange rates, fees, and budgeting in a new currency can feel like an uphill battle. Without a good system, it’s all too easy to lose track of what you’re spending, end up overspending, or get caught off guard by exchange fees.

Luckily, keeping control of your finances while traveling isn’t as tricky as it seems. With a few tips and the right tools, you can stay on top of your money across currencies, avoid costly mistakes, and focus on enjoying your trip to the fullest.

Why Currency Management Matters for Travelers

When we’re on the road, we’re often spending more freely. We want to experience new foods, explore attractions, and perhaps buy a few souvenirs. However, managing multiple currencies adds a layer of complexity to travel budgeting:

- Exchange Rate Fluctuations: Exchange rates aren’t fixed and can vary day-to-day. Without understanding these changes, you might end up overspending or losing out on money.

- Foreign Transaction Fees: Banks often charge a percentage of each transaction made in a foreign currency, which can quickly add up.

- Budget Clarity: When you’re working with different currencies, it’s harder to know exactly how much you’re spending in relation to your home currency.

Properly managing your travel budget means knowing how much you’re really spending in your native currency. Here are some tried-and-true strategies to help you stay in control of your finances across borders.

Tips for Smart Currency Management When Traveling

1. Plan and Research Exchange Rates in Advance

Before you embark on your trip, research the current exchange rates and get an understanding of how much your home currency is worth in your destination’s currency. Websites like XE.com or apps like Revolut can provide real-time rates, helping you make more informed spending decisions.

Tip: It’s a good idea to check rates before you convert cash or make a purchase in a different currency to avoid paying excessive fees or poor exchange rates.

2. Use Credit Cards Wisely (and Avoid Unnecessary Fees)

Credit cards can be a convenient way to manage travel expenses. Some credit cards even offer zero foreign transaction fees and favorable exchange rates, making them excellent for travel. However, be sure to:

- Avoid using cards with high foreign transaction fees.

- Look for credit cards that offer real-time notifications to track spending as you go.

- Enable notifications to alert you to each transaction, which can help you keep tabs on your spending.

Bonus: Many travelers find credit card rewards valuable, especially for frequent travelers. If you have a card with travel rewards, using it abroad could earn you points for future trips!

3. Keep a Mix of Payment Options

While credit cards are great, it’s essential to have a mix of payment methods. Not every shop or restaurant abroad accepts cards, so carrying some local currency is a good idea. Be mindful, however, that ATMs and exchange counters may charge fees or offer poor exchange rates.

When you withdraw cash, try to do so less frequently and in reasonable amounts to avoid high ATM fees or excessive cash on hand.

4. Create a Daily Budget in the Local Currency

Setting a daily budget in the local currency can prevent you from overspending. For example, if you’re visiting Japan and want to stick to $100 a day, convert that into Japanese yen for the day’s spending. This way, you won’t have to mentally convert every time you make a purchase.

Tip: Keep a note on your phone with the conversion rate and a quick reference for your budget in both currencies so you can track spending without pulling out a calculator constantly.

5. Track and Monitor Your Spending

It’s easy to lose track of how much you’re spending while traveling, especially if you’re switching between cards and cash. Logging your expenses every day, either in a notebook or an app, is a simple way to see where your money is going. Tracking lets you adjust if you’re overspending in one area, helping you avoid surprises.

How Spentrip Makes Travel Expense Tracking Effortless

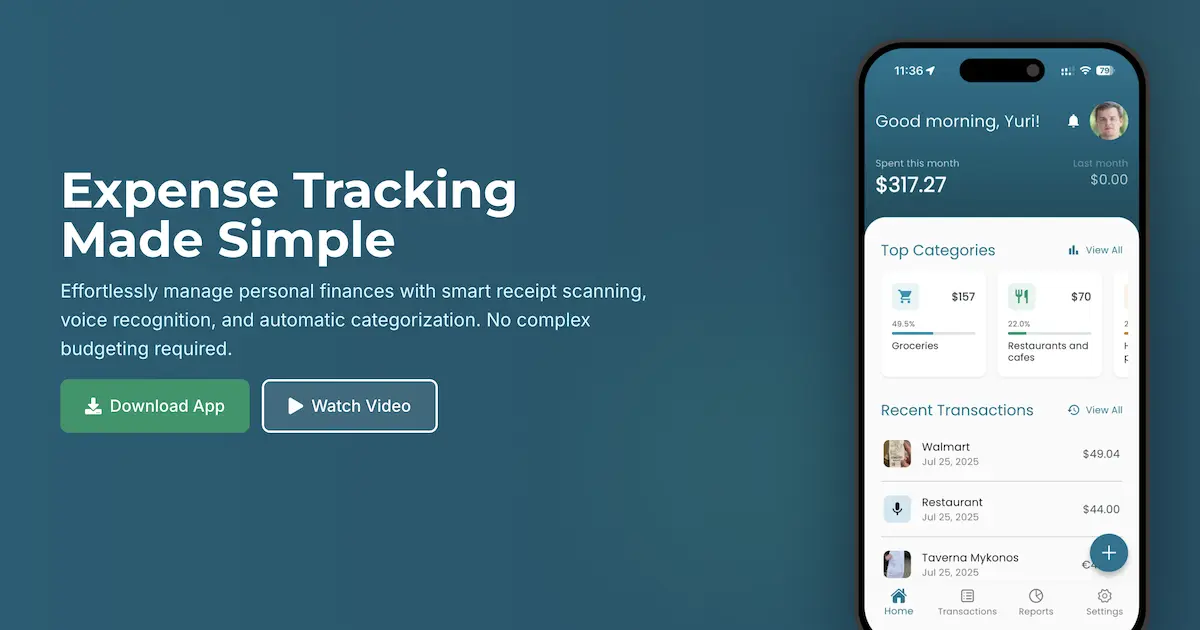

Managing multiple currencies and tracking travel expenses doesn’t have to be stressful. Spentrip is specifically designed for travelers who want to track their expenses without wasting precious vacation time on manual data entry.

Here’s how Spentrip revolutionizes travel expense management:

-

Trip-Based Organization: Unlike general expense trackers, Spentrip organizes all your expenses by trip, making it incredibly easy to see exactly how much each vacation costs. Whether you’re exploring Paris, backpacking through Southeast Asia, or enjoying a weekend getaway, all your expenses are neatly organized by journey.

-

Multi-Currency Support with Automatic Conversion: Spentrip seamlessly handles multiple currencies with automatic conversion, so you never have to worry about exchange rate calculations. Track expenses in local currencies while getting a clear view of your total spending in your home currency.

-

Intelligent Receipt Scanning: Simply snap a photo of your receipt — even international receipts in any language — and Spentrip instantly captures all expense details. No manual entry needed, which means more time enjoying your travels.

-

Voice Expense Tracking: Add expenses hands-free with quick voice commands while you’re on the go. Perfect for logging that street food purchase or taxi ride without interrupting your travel experience.

-

Travel-Focused Categories: Spentrip automatically categorizes your expenses into travel-relevant categories like accommodation, food, transportation, and entertainment, giving you clear insights into your travel spending patterns.

-

Visual Travel Insights: Get detailed reports and analytics about your spending habits while traveling. Compare expenses across different trips to make smarter budget decisions for future adventures.

-

Multilingual Receipt Recognition: Spentrip’s advanced recognition technology can understand receipts in any language, making it perfect for international travel without language barriers.

With Spentrip, you can travel freely while your expenses track themselves. The app requires virtually zero manual entry, so you spend seconds logging costs and the rest of your holiday exploring.

For those who need comprehensive expense tracking beyond travel, Receiptix offers an all-in-one solution for both travel and everyday expenses, with additional features like Telegram integration and Chrome extension support.

Conclusion

Managing multiple currencies while traveling might seem daunting, but it doesn’t have to be. With a little planning, the right payment methods, and smart budgeting, you can stay in control of your money on the go.

Spentrip is specifically designed to make travel expense tracking effortless, with trip-based organization and automatic currency conversion that eliminates the manual work. For travelers who want to focus on experiences rather than receipts, Spentrip offers the perfect solution. And if you need broader expense tracking capabilities for all aspects of your finances, Receiptix provides comprehensive expense management with AI-powered features.

As you venture out on your next trip, consider giving Spentrip a try to keep your travel finances organized while you focus on making memories. Happy travels!

Note: This blog post is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor for personalized guidance.